After an open house for a new construction home for sale, I received multiple inquiries regarding the estimated property tax for this property. I did some investigating and asking around, only to receive very little info on the subject, so I decided to look into this matter further to relay the most accurate information possible.

Prospective home buyers almost always have a specific budget in mind when shopping for a home, oftentimes this budget is based on calculating the monthly mortgage payment. The principal or original loan amount is fixed, and the interest rate is usually fixed as well.

However, homeowners pay property taxes as well, and the property’s estimated value and local mill rate will be needed to get this data.

Estimates are pretty easy to obtain for existing builds, but new construction proves a little more difficult, as previous years’ tax information is based on a real estate without “improvements” on the land, so we need to determine the value for the “improvements” on the land.

Market Value vs Assessed Value

Some buyers may have a good understanding of a home’s market value (amount a buyer will pay to purchase), but tax municipalities use a property’s assessed value (land + improvements), which is determined by the local Tax Assessor.

Tax assessors can calculate a home’s current assessed value as often as once per year; they may adjust the data when a property is sold, bought, built, or renovated, by examining the permits and paperwork filed with the local municipality.

According to Realtor.com,

homeowners can expect a “home’s assessed value

to amount to about 80% to 90% of its market value.”

USE COMPARABLES TO ESTIMATE VALUE

Looking at comparable homes is a good way to estimate a home’s value. If possible, locate a house built by the same builder. Then search for properties that seem comparable – same neighborhood, neighborhood/local amenities, property acreage, style, square footage, bedrooms, bath, property amenities, etc.

MILL LEVY OR MILL TAX RATE

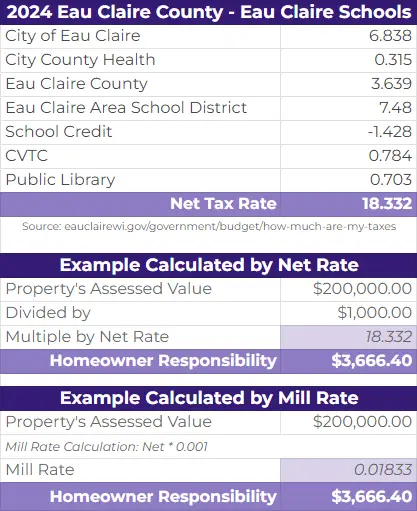

When attempting to calculate a home’s estimated property tax, you’ll need to know the “mill levy” or assessment rate for real estate in the local area. The tax rate varies, based on the public amenities and revenue required by local government – public schools, police, full-time fire department, city parks, playgrounds, etc.

Your area’s property tax rate should be listed on your local tax assessor or municipality website (Eau Claire City), and it’s typically represented as a percentage. To estimate property taxes, multiply the home’s assessed value by the mill levy. Mill levy or millage tax, is the rate a property is taxed at. Millage is .001, or means for every $1,000 in value, an owner will pay $1 in taxes.

There may also be additional taxes besides millage property taxes. Special assessments may be applied by the town, city, village and school district within the county.

It’s also important to note that property taxes can change over time, and the actual amount of property tax owed may vary from the estimate.

ADDITIONAL INFORMATION

It is best to contact your local assessor for information about your property assessment. The assessor is familiar with your local area and has a copy of the property tax state laws. If there are any questions, contact the local state’s Department of Revenue Equalization Bureau.

DISCLAIMER: Information contained here is not to be considered tax or financial advice. For situation-specific advice, please consult your accountant and/or attorney.